Throughout the UK, businesses have taken to new ways to initiate fundraising through innovative and technology-driven platforms. Crowdfunding is one of those methods to engage with potential investors, and the market has grown immensely since its humble start in 2011. Since that time, the total of funds raised through crowdfunding in the UK alone has been estimated between £600 and £800 million. In the years to come, UK businesses are anticipated to continue leaning on crowdfunding campaigns to help raise capital for their needs, and investors are becoming more likely to use platforms for crowdfunding to get in on the trend.

Although crowdfunding shows no signs of slowing down, businesses need to understand how the process of raising funds can help – or hinder – company objectives. First, an acknowledgment of what crowdfunding is in its various forms is essential to making a campaign successful.

Defining Crowdfunding

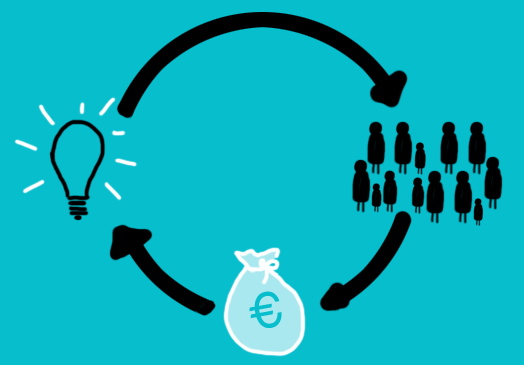

As the term implies, crowdfunding is the process of bringing together individuals who are willing to invest their money with individuals or businesses in need of those investments. Essentially, crowdfunding allows groups of people to pool their resources toward a common goal – in this case, funding a business launch, product or service, or idea. For companies unable or unwilling to explore more traditional sources of funding, such as lending or venture capital, crowdfunding can be a way to gain access to investors in a simple, streamlined manner.

Businesses interested in crowdfunding need to also recognise that there are various types of campaigns that can be run to bring investors together. The most common among start-up and established companies is equity crowdfunding. Through this type of platform, individual investors receive a small share of ownership or equity in the business in exchange for their financial contribution. Companies may also use debt crowdfunding to raise capital, also known as peer-to-peer lending. Rewards and donation-based crowdfunding are also options, but these are typically slated for smaller campaigns or those surrounding a specific product or social movement.

Understanding the Alternatives

According to a finance expert from Money Pug, a site used to compare short-term loans, small businesses may find the results they are seeking through crowdfunding, particularly when access to other forms of financing are not readily available. For instance, a traditional bank loan, either offered to the business or the individual business owner, requires an application and verification of financial standing in many cases. If a business is unable to provide this, crowdfunding may be a smart alternative.

Companies may also look to solutions outside of crowdfunding like investments from equity partners such as angel investors or venture capitalists. These often large investments are most readily available to companies with high-growth potential, such as those in technology fields or innovative industries. Other forms of financing, such as invoice factoring or lines of credit, may also be viable options for businesses in the UK that do not want to give up equity in their company in exchange for capital.

Creating a Successful Campaign

Once a business has determined that crowdfunding is the right fit, there are several steps to take to ensure a successful campaign. First, selecting the right platform is a must, given that not all crowdfunding sites serve the same type of campaign or the same category of business. For companies interested in equity crowdfunding, sites including Syndicate Room, Seedrs, and Crowdcube are the most popular. Donation or rewards-based campaigns fare much better on sites like Indiegogo and Kickstarter.

After selecting a platform to use for a new crowdfunding campaign, a business needs to plan for the launch. This entails the creation or update of a business plan, as well as a distinct purpose behind the funding. Companies that have a compelling story behind their campaign, in terms of why the funds are needed and where they might be used, are likely to have a stronger connection with investors and therefore, a higher rate of success in fundraising.

Businesses in nearly any industry can utilise crowdfunding in some shape or form to help with fundraising efforts over time. However, to be successful, companies must understand the type of crowdfunding that will work best for their capital needs, the platforms to use to reach potential investors, and the alternatives should crowdfunding not be the best source of financing for a particular project or idea.

Leave a Reply