When you’re preparing for an international trip, you expect to pay for airfare, accommodations, transportation, and meals, but often there are unexpected expenses that might have been avoided. Ten dollars for airport Wi-Fi or six bucks for an inflight meal may not seem like much by themselves, but if you’re gone for a few weeks, those unexpected expenses can quickly add up and throw your travel budget way off. Here are some helpful tips on how to avoid these five unexpected international expenses on your next trip.

Banking Fees

It’s your money, yet sometimes you’re charged an extraordinary amount just to access it. It doesn’t seem fair, but ATM fees, currency exchange fees, and foreign currency fees on your credit card can really add up fast. The easiest way to avoid getting nickel and dimed for a bunch of extra banking fees is to exchange a good deal of money at your home banking branch before you leave. How much should you withdraw? It really depends on how long you’re going to be gone and where you’re going, but at a minimum you should withdraw an amount equal to your total food allowance plus enough for shopping.

Additional Luggage Fees

Many airlines now charge you to check your bags. Review all the fine print ahead of time, especially if you’re booking through a third-party provider over the internet. Their prices might seem cheaper at first, but when you research a bit you might find that the price doesn’t include any checked luggage. Also, since you can generally carry on two personal items, consider not checking any luggage at all by just packing light and using only carry-on bags. Always make sure you weigh your bags ahead of time to confirm that you’re under the weight limit. Just a couple of additional pounds could end up costing you a whole lot of extra money.

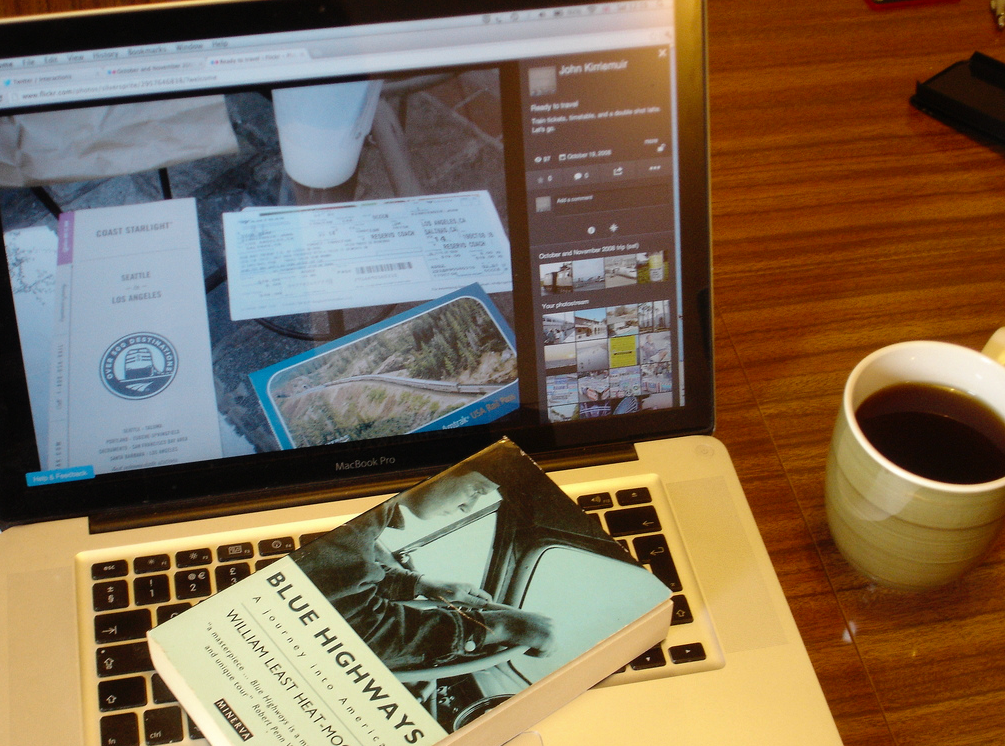

Cellphone Fees

Image via Flickr by WordShore

Being able to use your cellphone during your vacation is a convenience, but it’s also important for safety. If you find yourself in a jam, your cellphone could be a life saver. Unfortunately, those international roaming fees can be outrageous. Using your U.S.-based mobile phone while overseas can lead to some substantial unexpected charges, so you may want to consider turning off your data roaming while on vacation and using Wi-Fi on your smartphone instead. If you anticipate needing to make some calls, just buy a cheap prepaid phone or local SIM card at the airport in the country you’re visiting.

Wi-Fi can also be really expensive. Talk to your carrier before you leave to check out your options. For example, T-Mobile’s Gogo service allows you to have in-flight Wi-Fi and unlimited texting and voicemail access for a fraction of the cost that the airlines will charge.

Emergency Expenses

We hope you don’t have any emergencies while you’re overseas, but surprise medical expenses due to a simple accident can cost you a lot of money if you’re outside your American preferred provider network. Also, what if your bags are lost or stolen or there’s some kind of severe weather event and you get stranded? This is where travel insurance can really save the day, but always carefully read the small print before you purchase a policy. Many travel insurance packages only cover a couple of hundred dollars of expenses or have really high deductibles.

Souvenirs and Gifts

Most international travelers want to buy some souvenirs as mementos of their trip and to give as gifts to family and friends. Set a budget ahead of time and stick to it. Also, avoid buying things at the airport, where they always cost more and taxes are higher.

Just a little careful planning can save you hundreds or even thousands of dollars on unexpected travel expenses. Regardless of whether it’s banking fees, luggage fees, cellphone charges, or unexpected medical expenses, no one wants to blow their budget on such trivial stuff. Your travel budget should be used for just that: travel. You want it to be a memorable trip, in a good way! Keep these five things in mind and plan ahead.

Leave a Reply